35+ what is a reverse annuity mortgage

Web Reverse Annuity Mortgage Law and Legal Definition. Get A Free Information Kit.

The Mortgage Types In The Netherlands Linear And Annuities Nl Explained

Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage.

. Web A reverse annuity mortgage is specifically for homeowners aged 62 and up who need some extra cash. Reverse Annuity Mortgage is a mortgage in which the lender disburses money over a long period to provide regular. Web A reverse mortgage loan is not free money.

Ad Learn More about How Annuities Work from Fidelity. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. A reverse mortgage annuity is a loan that allows seniors to access the equity in their home without having to sell it.

Web The entire purpose of the reverse mortgage annuity is to use your home equity loan to generate additional income and use the value of your home to repay the. A reverse mortgage allows qualified homeowners to dip into their home equity without selling their house. Ad Get this must-read guide if you are considering investing in annuities.

Web Reverse mortgages allow elderly homeowners to convert their home equity into spendable funds during their retirement years but not necessarily for life. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web A reverse annuity mortgage is a loan that allows borrowers to turn their home equity into cash without making monthly mortgage payments.

It allows you to cash in some of your homes equity without having to sell or. Ad Compare the Best Reverse Mortgage Lenders. For Homeowners Age 61.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Web The meaning of REVERSE ANNUITY MORTGAGE is a loan against home equity that provides an annuity to the homeowner and is repayable at the time the home is sold. This type of loan has.

For Homeowners Age 61. It is a loan where borrowed money interest fees each month rising loan balance. For Homeowners Age 61.

The homeowners or their heirs. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web A reverse annuity mortgage is a loan that is secured against the value of your home.

Web This specially tailored reverse annuity mortgage allows homeowners to sell part or all of their house now but to remain in it until they die. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. For Homeowners Age 61.

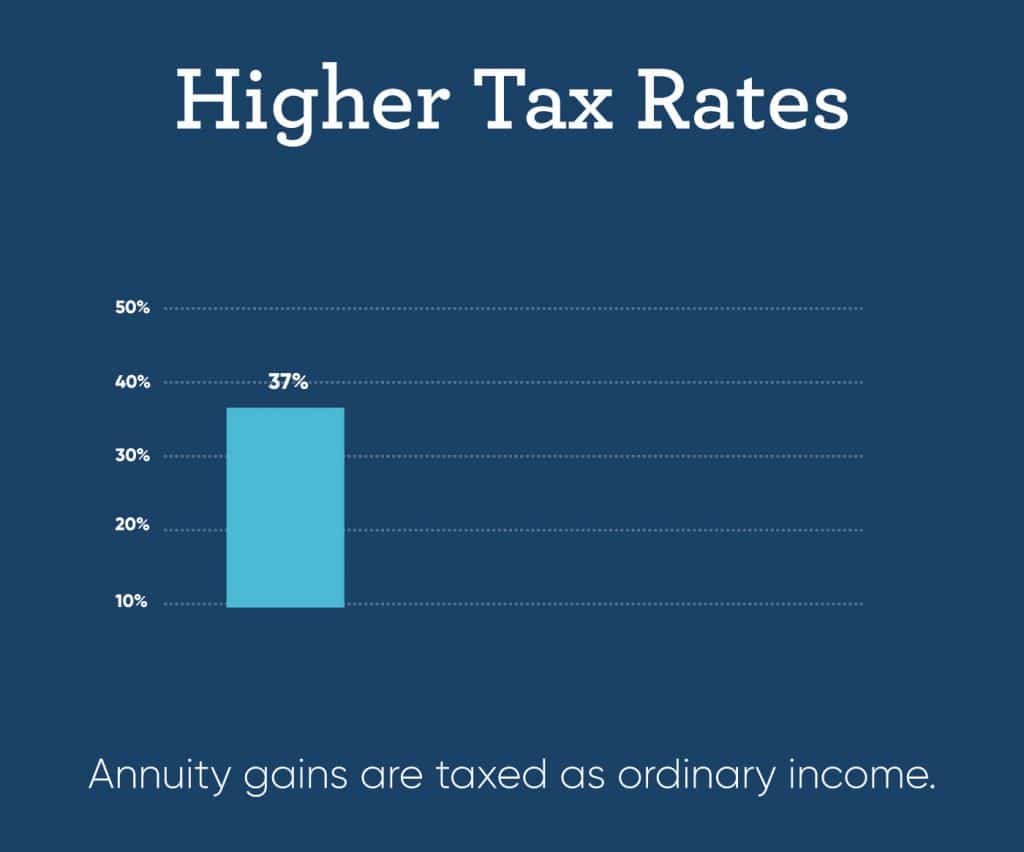

Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. They can use this cash to pay for repairs. Annuities are often complex retirement investment products.

This is a loan that allows homeowners aged 62 years and above to borrow money and use their homes as security for the loan. Web A reverse annuity mortgage or RAM is a loan for seniors who have paid off their houses but cannot afford to stay in them or require extra money for home repair. RAM can be repaid to the lender at any.

Web What is a Reverse Annuity Mortgage. Ad Compare the Best Reverse Mortgage Lenders. A reverse annuity mortgage is a loan that is secured against the value of your home.

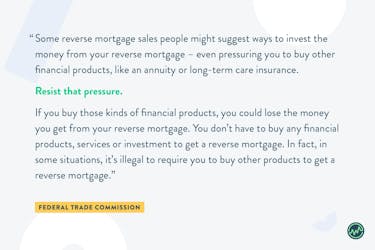

Web A reverse mortgage increases your debt and can use up your equity. Web To meet the definition of a reverse mortgage transaction a creditor cannot require any principal interest or shared appreciation or equity to be due and payable other than in. Web A surrender charge is a percentage of money you must pay or surrender to the insurance company for taking money out of the annuity prior to a designated term.

20 Years of Experience Providing Expert Financial Advice. It provides money that retirees are able. It allows you to cash in some of your.

Get A Free Information Kit. Web The reverse annuity mortgage is a provision for elderly individuals who requires some extra income to cover their overhead expenses. Web What Is A Reverse Mortgage Annuity.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Web What Is Reverse Annuity Mortgage. Web reverse annuity mortgage noun a type of home mortgage under which an elderly homeowner is allowed a long-term loan in the form of monthly payments against his or.

Ad Americas 1 Independently Rated Source for Annuities. Learn some startling facts.

Mortgage Professor Why Reverse Mortgage Funded Annuities Should Lead A Federal Tax Code Change Reverse Mortgage Daily

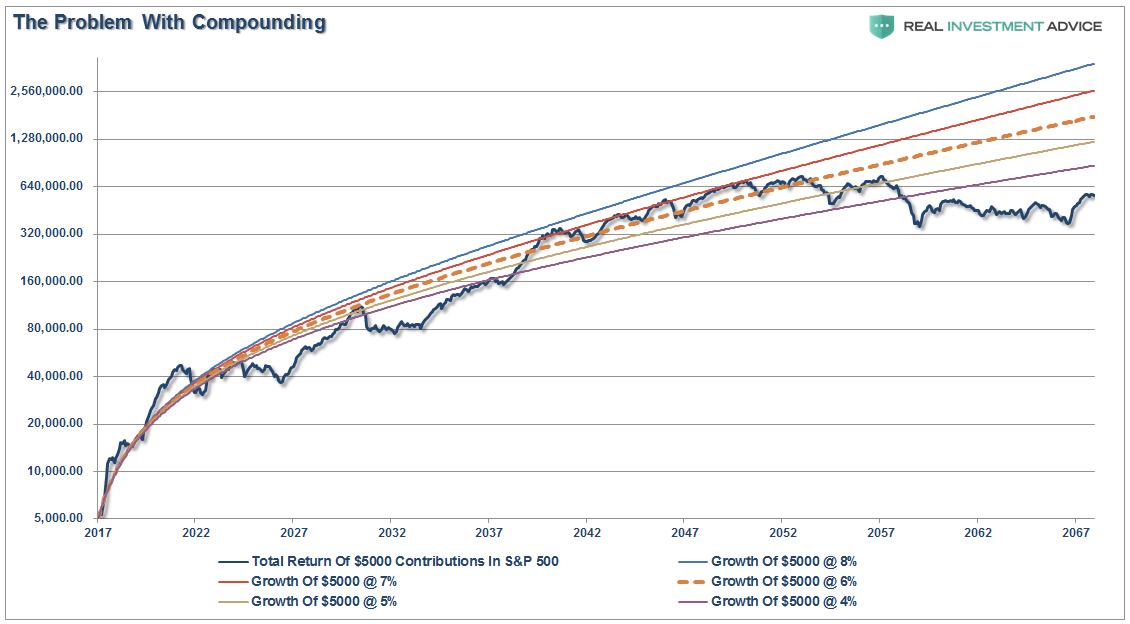

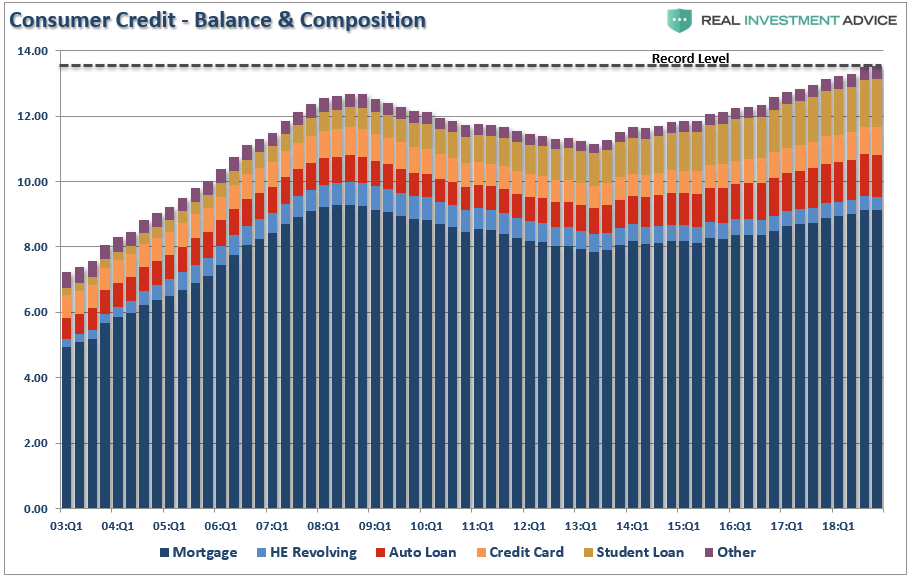

Boomers Are Facing A Financial Crisis Seeking Alpha

Boomers Are Facing A Financial Crisis Seeking Alpha

Reverse Mortgage Calculator How Does It Work And Examples

What Is A Reverse Mortgage The A Z Guide By Arlo

Reverse Mortgage Guide On Reverse Mortgage Loan Scheme

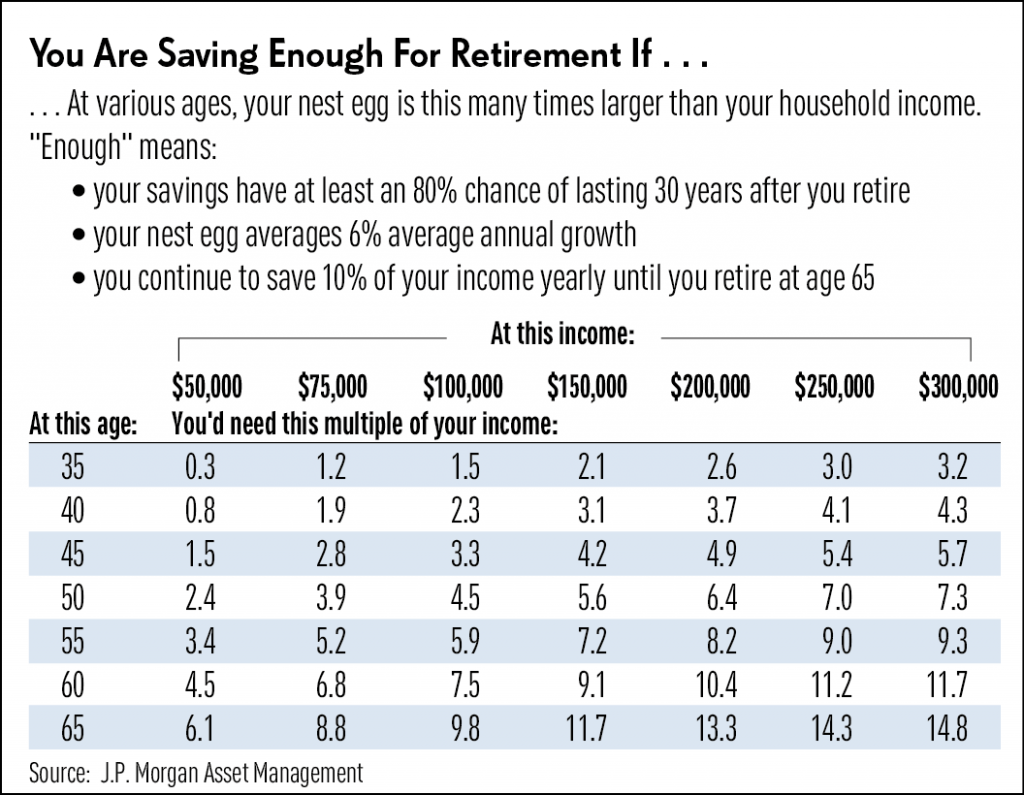

How Should A 35 Year Old With No Investments Start Planning For Retirement Quora

Reverse Home Mortgage Vs Immediate Annuity Goodlife

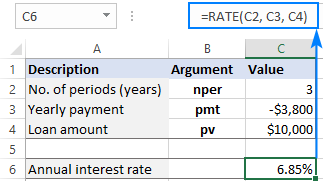

Using Rate Function In Excel To Calculate Interest Rate

Definition Of Reverse Annuity Mortgage Ram Clear Capital Glossary Of Terms

How To Use A Reverse Annuity Mortgage To Increase Your Retirement Income Wealthfit

Reverse Home Mortgage Vs Immediate Annuity Goodlife

Calculate Monthly Payments For Mortgage Or Annuity Part A Youtube

The Biggest Retirement Costs Shocks And Risks Milwaukee Financial Retirement Advisors Keil Financial

Reverse Annuity Mortgage Loan Rates Lenders Qualifications

Reverse Home Mortgage Vs Immediate Annuity Goodlife

Boomers Are Facing A Financial Crisis Seeking Alpha